讲讲我了解的PHD“奖学金”

4132843

这两年总有学弟学妹问我Ph.D“奖学金”的相关事情,我在地里刨了一下确实是没有发现有比较“奖学金”的帖子,不如在这里以我们学校(WPI)为例跟大家唠唠,算抛砖引玉,理解可能片面不足的地方还请各位学友补充。并且我是以wpi的情况为例进行的解释,其他学校不一定适用,如果您的学校跟我们不一样请跟帖我会吧内容更新到一楼。首先来讲,在我看来“奖学金”分广义和狭义的。一般父母跟亲人朋友说我孩子在XXXX大学读博,全奖。这里的“全奖”就是广义的奖学金(fellow+Ta+Ra)。而狭义的奖学金(真正的奖学金)在我们学校其实单独指的是fellowship。

FELLOWSHIP: 首先来说fellowship.之所以说它是真正的奖学金,是因为fellowship的offer内并没有规定你的义务,至少在我们学校是这样的。可以大致认为给你了fellowship就可以躺着拿钱了。我们学校一般fellow 一给都是给一年的。然而,从我接触的朋友来看,一般拿到fellowship的同学真的躺着拿钱不干活整天还觉得不幸福的话,那么这哥们儿离凉也不远了。除了没有规定“义务”以外,fellowship跟Ta Ra最大的区别在于这笔收入是不上税的。就是因为这个不上税的特点导致我的小伙伴每月收入都比咱多一点(不代扣税)。具体条款其实IRS有给出,我贴在帖子的后面,有兴趣的同学可以自己去研究。fellow的来源其实必将广泛,有来自于学校的grant,其他学校的grant,然后校友捐赠啊什的。 不同的fellowship和scholarship包含的内容不太一样所以很难用统一的情况来说,我只能说,一般来说fellow会给付一定的学分以及每月给一些生活费,生活费的钱数跟本校的TA/RA的标准类似,上下会有浮动。当然还会有一些特殊的scholarship是为了解决特定的问题设立的,比如我自己就用过学校的一个特殊的奖学金补了毕业所缺的最后一个学分。

然后说Ta和Ra。其实我认识的大部分(90%)同学都是拿的这两种钱,所以这也是我们说的最多的“奖学金”。然而,我其实一直不认为他是“奖学金”,也很赞同我们学校cssa的一个解释“TA/RA is not scholarship so it is NOT tax free.”其实我觉得与其说Ta/ Ra 是奖学金,不如说它们是助学金或者”劳动所得”,因为他们的offer中都规定了你的义务。我们学校工资是半月发的,ta和ra的每次发的钱数是一样的。

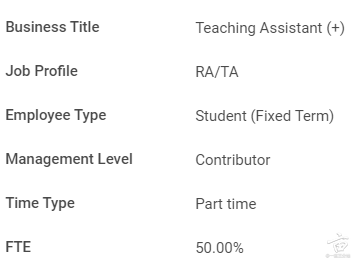

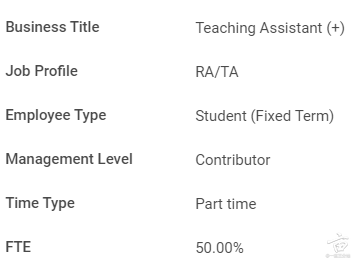

RA:说来惭愧,我做了两年Ra,但是一直没加到过RA的offer letter。一般来说ra是 50%的FTE,也就是说这个岗位要求你一周做20小时的科研工作,而给你的钱是这20小时的报酬。一般Ra的来源是带你的老板拉来的funding(可以认为是老板的钱)。因为我自己没见过ra的offer letter,所以我不知道在聘书中是规定的每年工作9个月还是12个月(因为ta规定的是9个月)。不过我和朋友们一般都是能拿到12个月的钱。Ra每年给的学分数其实看老板了,我有的朋友是给20分有的给18分,这东西当然给的越多越好,其实吧,如果选的都是自己老板的research分数对于老板来说给18还是20区别不是特别大,所以我周围给20分的还是大多数。我听看到过自己offer的小伙伴说offer上写的也是1年的。

TA:我们学校的Ta offer中明确规定了聘用期(9个月),总共给负担的学分数(20),以及公共发的stipend。在workday中可以看到Ta/ Ra都是有 50%的 FTE的。我印象深刻的是,学校每年的新TA training其实都会讲,学校每年花费在TA身上的钱除以每周要工作20小时,相当于付了70+的时薪。Ta一般会负担一些教学任务,有的是教课(很罕见),有的是带实验改作业什么的(常见)。我们学校是term制的,一年4个term。正常情况下每个Ta每个term会被分给1-2门课。Ta的钱的来源一般是学院/学校的经费,这笔钱一般不是老板自己出的。在我们学校很多老板招新的phd的时候喜欢给Ta,然后两年以后转做Ra. 我个人的理解是这样可以节省老板们的一些经费,毕竟新phd前几年会选修一些课程,这些课程的学费会分流到各个任课教师。 而两年后,大部分的学分都成了research学分,这些学分的学费有很大部分还是会回到老板那里。 可能个人理解比较片面,不喜勿喷。我这么其实是想安慰下拿到TA的同学。我自己是做过好几年Ta的,但是发现有些同学非常抵触Ta,不知道他们觉得ta比ra低一等还是怎么着。其实我觉得duck不必如此。无论ta还是ra,其实都是劳动所得,这玩儿没有什么高低贵贱之分。诚然,TA会比RA多耽搁一些时间,比如改作业答疑啊什么的,但时research并不是生活的全部,我个人就在做ta的期间结识了不少新的朋友,而且前两年来到新的地方人生地不熟多个朋友多条路,我觉得挺好的。因为我们学校Ta一年只给解决9个月的生活费,所以好一点的老板在暑假的时候都会把自己的学生转成RA, 发3个月的钱。

总结来说,我们学校Fellowship最爽,什么都不干“躺着拿钱”;Ra 因为工作职责是和phd的本质工作重合,所以算是科研换工资;Ta的收入来源于做教学助手代课改作业带实验,肯能会影响一些科研工作,但是会认识更多的的新朋友。但是无论给的那种奖学金,都是对以往的一种认可,而不是以后。无论fellow ra还是ta都是一年已给的,今年给你了不代表你躺着什么都不干明年还能给你,大家耗子尾汁:)

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

IRS关于奖学金征税的解释

Topic No. 421 Scholarships, Fellowship Grants, and Other Grants

A scholarship is generally an amount paid or allowed to a student at an educational institution for the purpose of study. A fellowship grant is generally an amount paid or allowed to an individual for the purpose of study or research. Other types of grants include need-based grants (such as Pell Grants) and Fulbright grants.

Tax-Free

If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. Scholarships, fellowship grants, and other grants are tax-free if you meet the following conditions:

You're a candidate for a degree at an educational institution that maintains a regular faculty and curriculum and normally has a regularly enrolled body of students in attendance at the place where it carries on its educational activities; and

The amounts you receive are used to pay for tuition and fees required for enrollment or attendance at the educational institution, or for fees, books, supplies, and equipment required for courses at the educational institution.

Taxable

You must include in gross income:

Amounts used for incidental expenses, such as room and board, travel, and optional equipment.

Amounts received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant. However, you don't need to include in gross income any amounts you receive for services that are required by the National Health Service Corps Scholarship Program, the Armed Forces Health Professions Scholarship and Financial Assistance Program, or a comprehensive student work-learning-service program (as defined in section 448(e) of the Higher Education Act of 1965) operated by a work college.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

WPI CSSA关于TA/RA 收税的科普贴:

TA/RA is not scholarship so it is NOT tax free.

Reference (related documents): WPI TAX Workshop on March Xth. See updated information in International House.

Publication No. 519, 520, 901, IRB (Internal Revenue Bullitine).

Written in the treaty (artical 20), for students there are three items

under tax exemption. They are: 1. payments received from aboard; 2.

grants, fellowship and scholarship from tax exemption institution; 3. first

$5,000 personal income per taxable year.

The question boils down to if RA/TA belongs to scholarship/fellowhsip/grants

or payment for services (personal income). According to page 2 of

Pub 520, the answer is: RA/TA is payment for service, even as partial

requirement for a degree. (Term "payment for service" is defined in this

page). So, RA/TA holders will enjoy tax exemption on the first $5,000 per

tax year.

To claim this $5,000 tax exemption, go to Payroll office and file certain

IRS forms (which are available at Payroll office) at the begining of each

tax year (Feb.) so that no income tax will be withheld for the first $5,000

per tax year. Or you can wait until the tax season and get it back through

tax returns (which means you will lose some interest income).

补充内容 (2020-12-22 12:11):

Stony Brook CS PhD感谢gqyz01sw 的dp(具体在4垅)

总结来说:

Fellowship:很难拿,拿到的话也几乎只有一年

学费和工资分配是分开的,但是学费减免要有TA/RA appointment。

Tuition Scholarship:给9-12学分,...

补充内容 (2020-12-22 22:48):

10垅有位学友提到他了解到有些学校的fellow只给公民和绿卡。我觉得这个情况可能因学校而定,我们学校是会给F-1的。

补充内容 (2020-12-23 00:19):

14垅的学友提到brown的cs PHD,第一年都是给fellow。每月发的钱数大概是3200-3400

补充内容 (2020-12-23 12:01):

有学友提到了fellowship每月给的钱的税务问题,我发现各学校的操作和指导可能不一样。所以有幸拿到fellowship并且是第一次报税的话,还请咨询下本校的international office和Bursar office,以本校的解释为准

补充内容 (2021-1-13 23:53):

推荐一个学友的帖子,关于TA的自我修养

instant.1point3acres.cn

FELLOWSHIP: 首先来说fellowship.之所以说它是真正的奖学金,是因为fellowship的offer内并没有规定你的义务,至少在我们学校是这样的。可以大致认为给你了fellowship就可以躺着拿钱了。我们学校一般fellow 一给都是给一年的。然而,从我接触的朋友来看,一般拿到fellowship的同学真的躺着拿钱不干活整天还觉得不幸福的话,那么这哥们儿离凉也不远了。除了没有规定“义务”以外,fellowship跟Ta Ra最大的区别在于这笔收入是不上税的。就是因为这个不上税的特点导致我的小伙伴每月收入都比咱多一点(不代扣税)。具体条款其实IRS有给出,我贴在帖子的后面,有兴趣的同学可以自己去研究。fellow的来源其实必将广泛,有来自于学校的grant,其他学校的grant,然后校友捐赠啊什的。 不同的fellowship和scholarship包含的内容不太一样所以很难用统一的情况来说,我只能说,一般来说fellow会给付一定的学分以及每月给一些生活费,生活费的钱数跟本校的TA/RA的标准类似,上下会有浮动。当然还会有一些特殊的scholarship是为了解决特定的问题设立的,比如我自己就用过学校的一个特殊的奖学金补了毕业所缺的最后一个学分。

然后说Ta和Ra。其实我认识的大部分(90%)同学都是拿的这两种钱,所以这也是我们说的最多的“奖学金”。然而,我其实一直不认为他是“奖学金”,也很赞同我们学校cssa的一个解释“TA/RA is not scholarship so it is NOT tax free.”其实我觉得与其说Ta/ Ra 是奖学金,不如说它们是助学金或者”劳动所得”,因为他们的offer中都规定了你的义务。我们学校工资是半月发的,ta和ra的每次发的钱数是一样的。

RA:说来惭愧,我做了两年Ra,但是一直没加到过RA的offer letter。一般来说ra是 50%的FTE,也就是说这个岗位要求你一周做20小时的科研工作,而给你的钱是这20小时的报酬。一般Ra的来源是带你的老板拉来的funding(可以认为是老板的钱)。因为我自己没见过ra的offer letter,所以我不知道在聘书中是规定的每年工作9个月还是12个月(因为ta规定的是9个月)。不过我和朋友们一般都是能拿到12个月的钱。Ra每年给的学分数其实看老板了,我有的朋友是给20分有的给18分,这东西当然给的越多越好,其实吧,如果选的都是自己老板的research分数对于老板来说给18还是20区别不是特别大,所以我周围给20分的还是大多数。我听看到过自己offer的小伙伴说offer上写的也是1年的。

TA:我们学校的Ta offer中明确规定了聘用期(9个月),总共给负担的学分数(20),以及公共发的stipend。在workday中可以看到Ta/ Ra都是有 50%的 FTE的。我印象深刻的是,学校每年的新TA training其实都会讲,学校每年花费在TA身上的钱除以每周要工作20小时,相当于付了70+的时薪。Ta一般会负担一些教学任务,有的是教课(很罕见),有的是带实验改作业什么的(常见)。我们学校是term制的,一年4个term。正常情况下每个Ta每个term会被分给1-2门课。Ta的钱的来源一般是学院/学校的经费,这笔钱一般不是老板自己出的。在我们学校很多老板招新的phd的时候喜欢给Ta,然后两年以后转做Ra. 我个人的理解是这样可以节省老板们的一些经费,毕竟新phd前几年会选修一些课程,这些课程的学费会分流到各个任课教师。 而两年后,大部分的学分都成了research学分,这些学分的学费有很大部分还是会回到老板那里。 可能个人理解比较片面,不喜勿喷。我这么其实是想安慰下拿到TA的同学。我自己是做过好几年Ta的,但是发现有些同学非常抵触Ta,不知道他们觉得ta比ra低一等还是怎么着。其实我觉得duck不必如此。无论ta还是ra,其实都是劳动所得,这玩儿没有什么高低贵贱之分。诚然,TA会比RA多耽搁一些时间,比如改作业答疑啊什么的,但时research并不是生活的全部,我个人就在做ta的期间结识了不少新的朋友,而且前两年来到新的地方人生地不熟多个朋友多条路,我觉得挺好的。因为我们学校Ta一年只给解决9个月的生活费,所以好一点的老板在暑假的时候都会把自己的学生转成RA, 发3个月的钱。

总结来说,我们学校Fellowship最爽,什么都不干“躺着拿钱”;Ra 因为工作职责是和phd的本质工作重合,所以算是科研换工资;Ta的收入来源于做教学助手代课改作业带实验,肯能会影响一些科研工作,但是会认识更多的的新朋友。但是无论给的那种奖学金,都是对以往的一种认可,而不是以后。无论fellow ra还是ta都是一年已给的,今年给你了不代表你躺着什么都不干明年还能给你,大家耗子尾汁:)

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

IRS关于奖学金征税的解释

Topic No. 421 Scholarships, Fellowship Grants, and Other Grants

A scholarship is generally an amount paid or allowed to a student at an educational institution for the purpose of study. A fellowship grant is generally an amount paid or allowed to an individual for the purpose of study or research. Other types of grants include need-based grants (such as Pell Grants) and Fulbright grants.

Tax-Free

If you receive a scholarship, a fellowship grant, or other grant, all or part of the amounts you receive may be tax-free. Scholarships, fellowship grants, and other grants are tax-free if you meet the following conditions:

You're a candidate for a degree at an educational institution that maintains a regular faculty and curriculum and normally has a regularly enrolled body of students in attendance at the place where it carries on its educational activities; and

The amounts you receive are used to pay for tuition and fees required for enrollment or attendance at the educational institution, or for fees, books, supplies, and equipment required for courses at the educational institution.

Taxable

You must include in gross income:

Amounts used for incidental expenses, such as room and board, travel, and optional equipment.

Amounts received as payments for teaching, research, or other services required as a condition for receiving the scholarship or fellowship grant. However, you don't need to include in gross income any amounts you receive for services that are required by the National Health Service Corps Scholarship Program, the Armed Forces Health Professions Scholarship and Financial Assistance Program, or a comprehensive student work-learning-service program (as defined in section 448(e) of the Higher Education Act of 1965) operated by a work college.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------

WPI CSSA关于TA/RA 收税的科普贴:

TA/RA is not scholarship so it is NOT tax free.

Reference (related documents): WPI TAX Workshop on March Xth. See updated information in International House.

Publication No. 519, 520, 901, IRB (Internal Revenue Bullitine).

Written in the treaty (artical 20), for students there are three items

under tax exemption. They are: 1. payments received from aboard; 2.

grants, fellowship and scholarship from tax exemption institution; 3. first

$5,000 personal income per taxable year.

The question boils down to if RA/TA belongs to scholarship/fellowhsip/grants

or payment for services (personal income). According to page 2 of

Pub 520, the answer is: RA/TA is payment for service, even as partial

requirement for a degree. (Term "payment for service" is defined in this

page). So, RA/TA holders will enjoy tax exemption on the first $5,000 per

tax year.

To claim this $5,000 tax exemption, go to Payroll office and file certain

IRS forms (which are available at Payroll office) at the begining of each

tax year (Feb.) so that no income tax will be withheld for the first $5,000

per tax year. Or you can wait until the tax season and get it back through

tax returns (which means you will lose some interest income).

补充内容 (2020-12-22 12:11):

Stony Brook CS PhD感谢gqyz01sw 的dp(具体在4垅)

总结来说:

Fellowship:很难拿,拿到的话也几乎只有一年

学费和工资分配是分开的,但是学费减免要有TA/RA appointment。

Tuition Scholarship:给9-12学分,...

补充内容 (2020-12-22 22:48):

10垅有位学友提到他了解到有些学校的fellow只给公民和绿卡。我觉得这个情况可能因学校而定,我们学校是会给F-1的。

补充内容 (2020-12-23 00:19):

14垅的学友提到brown的cs PHD,第一年都是给fellow。每月发的钱数大概是3200-3400

补充内容 (2020-12-23 12:01):

有学友提到了fellowship每月给的钱的税务问题,我发现各学校的操作和指导可能不一样。所以有幸拿到fellowship并且是第一次报税的话,还请咨询下本校的international office和Bursar office,以本校的解释为准

补充内容 (2021-1-13 23:53):

推荐一个学友的帖子,关于TA的自我修养

instant.1point3acres.cn